We have noted a rising number of questions about iStock exclusivity and the other options out there in the last few weeks. Not surprising, as all of the major changes we have seen at iStock in the last four years have raised concerns and worries, changed individual perceptions and had impact on download volumes and royalties paid.

So we thought it might be a good time – roughly six weeks after the implementation of the new credit system at iStock – to have a closer look at how things are developing. And how you can come to a personal decision to go or stay exclusive or non-exclusive with them.

How are earnings developing at iStock after the September 2014 change?

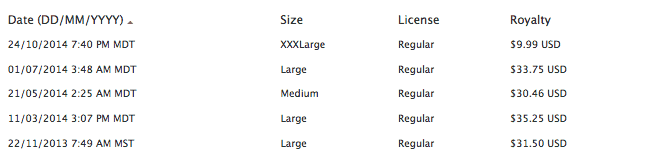

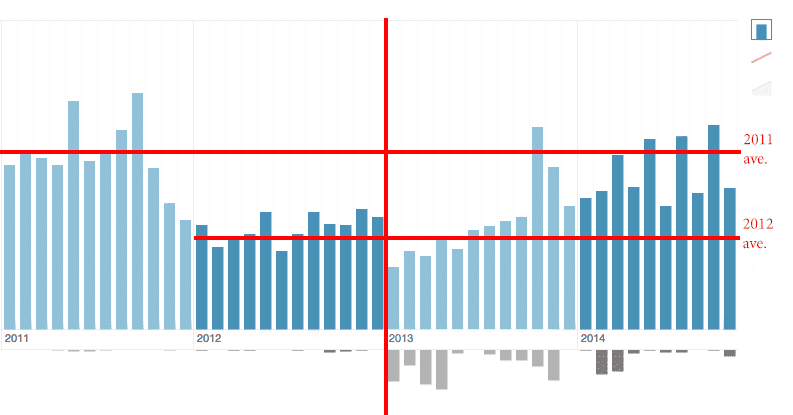

We are seeing people comparing their royalty development on images like the one above regularly. In this case we are looking at the sales on what was an image in The Agency Collection: It did not have many downloads in the past year but they all paid the contributor $30 or more per sale. And the downloads were in Medium or Large size. Now, after the change to a all-size-one-price model we are obviously seeing mostly downloads in the largest size available, and in this case the only sale after the change just made a fraction of the royalties it had generated before.

This is the most obvious change, so it gets noted a lot by contributors: Downloads in largest size, and especially the premium images are paying much less than before. But now let's have a look at a different exclusive image:

As you can see from the list above, it had three downloads since the change in September: All of them in XXXLarge size, and paying in the range of $9 – $12. This is a seasonal image, so you won't be surprised to see there were no downloads during spring and only one in August. The image has sold regularly last year however. And as you can see, in this particular case we are seeing downloads paying up to $14.25 in 2013 but most downloads were in Small or XSmall sizes paying only $1.82 or up to $4. So if you take this image as a basis for comparison, today's average royalties paid are higher than before the change.

If you take this into consideration, you can also figure out that your personal royalty development is likely to depend on the big question if your past earnings were mostly depending on the premium images (for those images you are likely to lose two thirds of the payments) or if a majority of your sales were coming from Essential or Signature images (for which you are now getting a larger payment than for the smaller downloads in the past).

Taking offense in the size customers are downloading?

Yes, there is a second development that some contributors seem to take offense in: Customers are now only downloading the largest available sizes for the images. Often at the same prices they typically paid for a medium file in the past.

We recommend to look at it from a customer perspective: The client is licensing a royalty free image, so they are allowed to use it for eternity and for multiple uses. In many cases, they have a certain use in mind already. In the past, they had to figure out what size they would need to have that image printed in their brochure, or how many pixels they would need to make the image look good on their web page.

Taking away the size based pricing, iStock has removed one obstacle out of the customer consideration: Just get the largest size now and find out which size to crop or downscale it to later. It is making the license purchase significantly easier for the customer.

You should also consider: The customer never paid for a certain size of a certain image. This is purely a contributors' perception because pricing was based on pixel sizes. For the customer, the general way of thinking is different: They paid for a more or less specific use they had in mind and an image that more or less specifically serves their needs. No customer thinks “I want an image with 750 x 500 pixels”, customers think “I need a title image making readers click on that link to the article I have written”. Our advice: Do not worry about the fact that you are now seeing only ultra large downloads on your images. While the customer might see it as convenient (which basically is a good thing because it makes the customer feel happy), it is very unlikely that the availability of larger resolutions will change the actual use of the image. The ad will still be printed in the same size in the magazines as before.

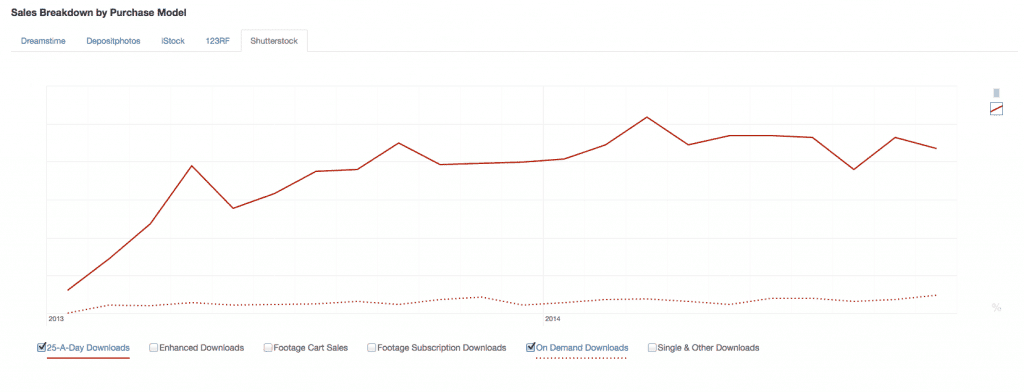

The second development: Subscriptions

Judging the development of licensing sales after the changes in September, many contributors may forget that there is a second development that started in March: The new subscription offer launched by iStock. Let's be straight: The old, credit based subscription offer iStock had in place never worked really well. It was a compromise between what customers were asking for (and paying for at other competitor sites) and what especially the exclusive contributor base at iStock were considering acceptable. But it just doesn't make sense to ask the customer to pay for a “subscription” priced similarly to what they pay for a 25 images/day subscription at other sites and then give them an amount of credits that wasn't even enough to buy a single larger files from the Signature+ or Vetta collections.

The new subscription offer is much more competitive with a twist: It still asks customers to pay a premium compared to the competing offers for the access to the exclusive images only iStock can offer. This allows iStock/Getty to pay the highest subscription royalties in the market today, at least for exclusive contributors. We know that many of you were opposed to the “all you can eat” mentality of subscription based licensing. The problem here is: The market did not agree. This type of offer has been out there for many years and it has gained a lot of market share over the years. Almost all other major competitors had subscription offers in place, and not being able to offer this at iStock has probably been one of the major reasons for clients to move away.

As you can see from the chart above (and we assume yours is looking similar), the subscription offer has been adopted very well by the customers. As a contributor, you may not like that development because they royalties paid are much lower than for credit based sales – but then again, you should consider that there are only two options: Either you take part in this market and get some of those subscription customers to stick around – or the market is going elsewhere where your images are being paid $0 because you don't have them on offer at other agencies.

The credit change will lead to more subscriptions

Now combining these two major changes, we are expecting to see a combined effect: While the new credit pricing has made larger downloads of premium images much cheaper as discussed above, customers in need of smaller images are unlikely to pay $30 per file for a web use. This is certainly one of the major critiques heard after the changes iStock applied in September. While Shutterstock has a image based offer for medium/web sized images, allowing the customers to download a higher number of images at smaller sizes, iStock has not implemented such a reduced size/price system.

So for this type of customers, we are seeing only three possible choices:

- Pay a significantly higher price for web sized images than before

- trying to find a cheaper place to license image elsewhere

- go for a subscription

The second option is certainly valid for a number of small image buyers who were not regularly buying image licenses. But the third option is actually realistic for independent graphic designers, blog or website owners with regular need of images. Many of them will now reconsider how much they paid for image licenses in the past and find the subscription offer a valid alternative. Therefore, we expect that with the new pricing the move to subscriptions will be accelerated. It probably would have happened (actually it already did happen, just outside of iStock in the past) anyways but the new credit system is an important change that will force customers to make that decision now rather than later.

As a result, we are expecting that very soon more than half of the downloads happening at iStock will come through the subscription offers. In comparison: At Shutterstock 80 to 90% of download volume is coming from subscriptions for most contributors, at Fotolia the number is between 50 and 60% of downloads, similarly to 123RF or Depositphotos.

Now there is a specific problem at iStock that makes the view into your download statistics more difficult: While other microstock sites are reporting all sales in real time, iStock only shows your credit based sales more or less live. Subscription downloads only get reported with a delay of a month. So when we assume these trends, you will not note them right now. The only thing you might be seeing is a drop in downloads (and apparently not all exclusive contributors agree with that) right now. When the busiest sales season is supposed to generate record downloads, your personal numbers might look small compared to your expectations. But this is partly due to the fact that you are not seeing half of the downloads your images are actually having. So the iStock system makes your downloads look worse than they actually might be.

Judging the results of the changes we have seen on iStock in 2014 by your downloads right now might not be a realistic assessment: First of all we are talking about changes that take some time to be adopted by the customer base; and in addition you are not able to track those trends in real time. Making a realistic assessment will take some time: Even customers switching from credits to subscriptions shortly after the changes to the credit systems would have used up their existing credit balance first, and they might have signed up for a subscription in late September or early October. So you won't see the true effects of the changes before mid November or even a few more months down the road.

Should you drop your iStock exclusivity now?

Well, there are good reasons to not rely on a single source of income. So in general there is a good reason why a huge amount of microstock contributors have chosen not to go exclusive with a single agency in the past.

But if your only or main considerations for dropping your iStock exclusivity are the recent changes at iStock, then you are not well advised: The introduction of a competitive subscription program and the new credit system are not inventions to lower your royalties. They are a reaction to the market – what clients are demanding and what clients are already able to get at competitive sites. Dropping exclusivity to distribute your images through all the other microstock agencies is not going to turn back times. It does not make much sense to claim that the changes at iStock are a bad thing and selling out your images cheap, and as a reaction move your images to the places that have been doing the very same thing for a long time, does it?

So you should be considering the options from an economic point of view: Are you likely to make more money by staying exclusively with iStock or is it more likely to make a better return on investment to be a non-exclusive contributor? And there is no answer to this question that can be applied easily to everyone, so we are not able to give a specific advice for your personal situation.

What can you expect to earn as a non-exclusive contributor

The main competitor Shutterstock is listed at the New York Stock Exchange and has to publish quarterly income statements. We can use those to deduct a general overview of the market: Based on the results of the first half of 2014, Shutterstock is expected to make an annual revenue of $325 million this year. They also have about 40 million files in their library at this time. Taking the average this means that each file generates around $8 this year. Of this, we estimate that Shutterstock is paying out about 30% of the revenue to its contributors, making this an average of $2.40 per file per year or $0.20 per file each month. As always with averages, “your mileage may vary”, some contributors are likely to exceed these averages by far while others might even generate less royalties from Shutterstock than this estimate would indicate.

We can also take into consideration that according to the monthly polls at MicroStockGroup, Shutterstock is the most important income source for non-exclusive contributors. While some contributors also make significant amounts of royalties from Fotolia or – even as a non-exclusive – from iStock and its partner program, as a general rule we can conclude that Shutterstock provides for about 40% of the overall royalties in the market.

Making another calculation, assuming that the $0.20 paid by Shutterstock per file monthly represent 40% of the total market, we can come to an assumption that the overall average royalty paid out in 2014 is about $0.50 per file per month in the microstock world. There are certainly examples of contributors who are closer to making $2 per file each month but for each of those high earners there are probably ten low earners only making $0.20 or less. Which of them are you going to be? We can't really tell but we would recommend going with the average number.

As we also have insights from what several exclusive contributors reported about their personal earnings in recent months, we know that there is a huge variance in earnings at iStock. Some contributors are still far ahead of the average $0.50 the market seems to be paying right now. For those contributors, it is very unlikely that they would earn more money if they decided to drop their exclusivity status. Even if their royalties have dropped by 60% or even 80% from their all time highs, it might just mean that they are now making $2 per image instead of the $5 or $8 they used to be seeing a few years ago. But even after those losses, you might still make more than the average non-exclusive contributor. If you are one of those lucky people, it is unlikely that dropping your exclusivity will increase your earnings anytime soon.

What if your earnings are below the market average?

However, there are cases – probably not just a few – of contributors who already dropped below this average market rate of $0.50 per file per month. If you are one of those, you should seriously consider if exclusivity at iStock/Getty is the best choice for you economically.

There still might be good reasons to stay exclusive: For example uploading to multiple images will cost more time than uploading to only one place. Though the amount of additional work probably tends to be overestimated by iStock exclusives due to their specific and over complicated system, you can still expect that adding agencies to your list of market places is likely to also add administrative work to your schedule.

Also, it could just be that your image are less attractive than the average image available in the market: If the type of images you create is not among the popular categories, you are unlikely to make the average amount of royalties as a non-exclusive contributor as well. This is not saying that your images are bad themselves. But having a portfolio of 5,000 photos documenting life in a small town in the Midwestern US might generate some downloads but they don't have the necessary appeal to the masses of buyers in advertising and the modern news business. It is important to be honest about your photography if you want to make an assessment about your potential earnings.

Still considering dropping exclusivity?

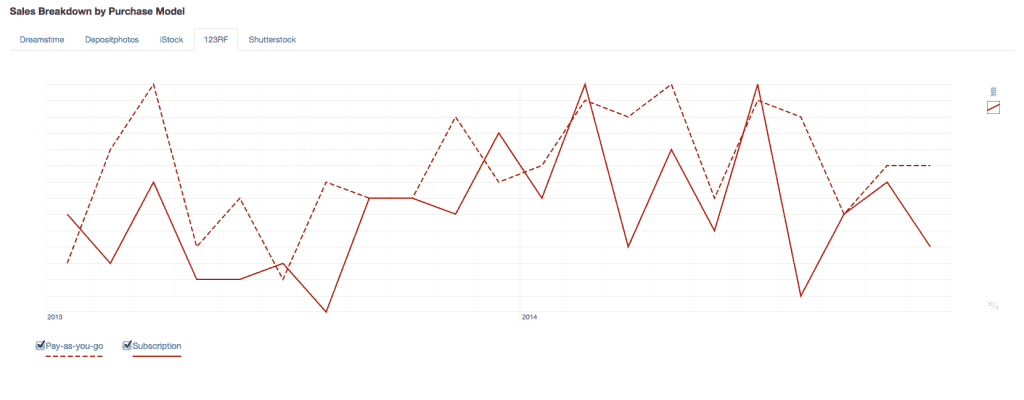

And now for those others… Finally, there probably is a group of contributors who kept shaking their heads to all those potential reasons to stay (or become) exclusive at iStock. Those might want to take a closer look at this sample contributors' experience.

We have prepared the chart above as a sample for a contributor who dropped his exclusivity almost two years ago after seeing a significant decline in his royalties at iStock the year before (the chart is prepared on StockPerformer, a great analytics platform for microstock image sales, both for exclusives and independents). We have added two horizontal lines – as you can see, it was quite quick in this case to get back to the lower line which represents the average royalty he had earned in 2012 as an exclusive contributor.

However, it took almost two years of constant work to get back to the levels of royalties he had the year before in 2011. The speed of your recovery in case you drop exclusivity also depends on the stage you are in – are you still making far more than the market average? Then the time to get back to your prior earning levels is likely to be longer than if you'd already earn much less than the average contributor does.

If you are among those, making less money from your images than you could probably expect based on the numbers presented above, willing to put in some additional work to upload to several agencies, hoping to see a positive development in your earnings, here is the last advice at this point: Maybe don't push the button right now. Before taking the final decision, make sure that you are really prepared to get your images out there as quickly as you can to make as much return as you can.

If you are insecure about what you need to do when and how, please make sure to bookmark our site, sign up for our newsletter or give us a like on Facebook. We are going to publish another article soon, discussing all the steps needed to prepare yourself before dropping exclusivity.

Disclaimer: The data were kindly supplied to us by two contributors on request.

Images: IngImage.com

2 Comments

Nice information – but I think you left out one important oversight. When an artist uploads to iStock and the images have uniqueness & production value the images are placed into the Signature + collection which “automatically” uploads to the gettyimages site as well as iStock. So when an artist has images in the Signature + collection the images are actually in two markets – iStock & gettyimages, with just one upload

I am exclusive at iStock and have been for a few years now & I know that sales from my Signature + collection that are on the gettyimages site have a very positive revenue effect on top of my regular iStock revenue. This should also be a large factor when someone is considerning dropping exclusivity at iStock.

Very true Steve, thank you for your comment.