Yesterday, Adobe has announced major changes to its Creative Cloud solutions, among those is the introduction of the Adobe Stock platform, based on the image library of microstock platform Fotolia. The announcement doesn't come as a surprise after Adobe's acquisition of Fotolia late last year.

What are the main changes for contributors?

Adobe Stock contains all images published on the Fotolia platform – with the exception of the premium collection Fotolia Infinite which is priced at a premium level – and there is no Opt-In/Opt-Out for this. The sales are being processed through the Fotolia platform and will be shown live as if they were sold through the Fotolia website directly.

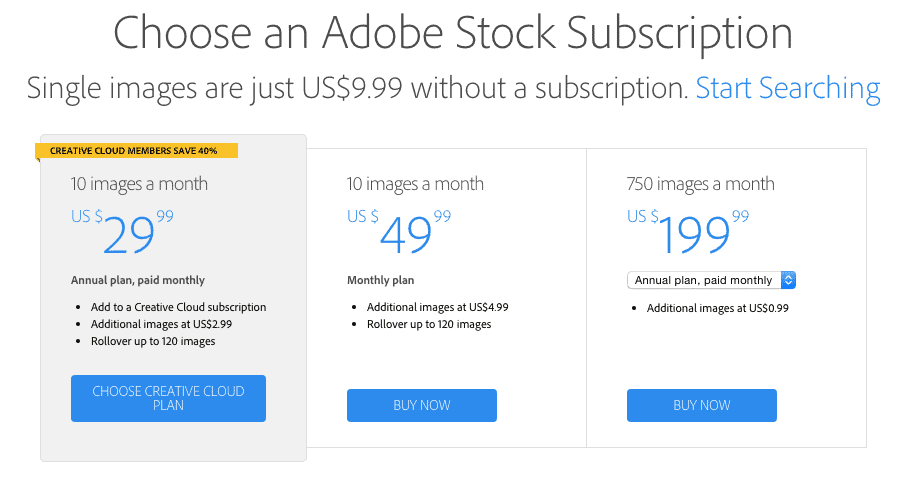

The pricing on Adobe Stock is simplified, there are no size based prices. A single image costs $9.99 (or € 9,99 in Euro countries). Monthly subscriptions can be bought for 10 images per month at $49,99 but existing customers with a Creative Cloud subscription can get the same package at $29,99. In addition, a annual subscription for 750 images per month (similar to offers of main competitors iStock by Getty Images and Shutterstock) can be purchased. Note that all prices are only available to active Adobe Creative Cloud Members.

The royalties paid to contributors will be at a flat 33% of the revenue. For most contributors, this is a raise compared to the ranking based royalty shares contributors receive when images are being sold through the Fotolia platform which continues to exist outside of the Adobe sites. There also is a minimum payment per download set at the same values contributors receive for subscription downloads on Fotolia, depending on the ranking level.

Changes in Counting of Subscription Downloads on Fotolia

Changes in Counting of Subscription Downloads on Fotolia

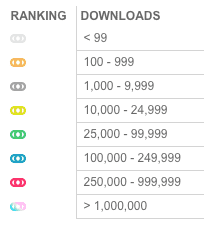

In another step, Adobe and Fotolia have decided to change their counting of subscription downloads towards the contributor rankings. All downloads will now be counted fully, not just one quarter download per subscription sale as in the past. This will help contributors reach the next level and therefore higher royalties for sales on the Fotolia platform.

Some contributors told us, that they have been lifted into the next higher ranking due that change, which will result in higher earnings as well. Thats a great way of motivation contributors to upload more content to Fotolia and Adobe Stock.

How do the Conditions compare to other Stock Agencies?

With a royalty share of 33% for all contributors, it is one of the rare occasions where a stock agency gives a huge increase in commission. The flat commission for subscriptions (except the daily subscription) will be increase from 20% (25% if you opted-in Dollar Photo Club) to 33%. This is a massive increase, which is a great sight for Fotolia contributors.However, also exclusive contributors are receiving a higher share of sales on the Fotolia platform, reaching from 35% up to beyond 50%. We don't know how many exclusive photographers Fotolia has at this point.

Payout for most common products (according to Fotolia's Website)*

| PRODUCT | PAYOUT |

|---|---|

| Adobe Stock – On Demand | 3.30 |

| Adobe Stock – 10 images a month (monthly) | 1.65 |

| Adobe Stock – 10 images a month (annual) | 0.99 |

| Fotolia – 5 images a month | 1.65 |

| Adobe Stock – 750 images per month | Minimum guarantee |

| Fotolia – Daily subscription plan | Minimum guarantee |

| All other products | 33% of the sale price |

* payout can vary by country depending on actual price in local currency

Compared to other offers in the market, a 33% share of sales is slightly above the average being paid by the large competitors Shutterstock and iStock by Getty Images – whereas the higher shares at iStock are solely reserved to their exclusive contributors. It compares well within the microstock market, though other new platforms like the EyeEm Market oder 500px Prime are offering higher percentages on higher prices but their market penetration is likely to be far smaller.

A positive Step for most Contributors

So, all in all, the percentage offered looks like a positive step for most contributors. However, the image prices are not based on the size/resolution the buyer is using. This is technically not surprising, as the integration of the platform into the CC applications like Photoshop is deep and seamless, so any additional step to choose image size etc. would have made this process more complicated than needed. The focus was clearly set on making the steps to search, buy and integrate stock images into designs as easy as possible.Here is a quick video how the Adobe Stock can be used within the Creative Cloud Apps:

Also, competitor Shutterstock has made no differentiation in pricing by resolution in the past (with the exception of the smaller Image Packs introduced eventually), and iStock has dropped their size based pricing last year. This seems to be a market trend, and is dictated by the trend to online, mobile and responsive designs these days which require larger resolutions for larger screens without actually increasing the visible size nor the actual customer value. Still, it will compare badly to large royalties coming from XL size priced at 10 or 20 credits on the Fotolia site.

Then again, it also raises the minimum price for smaller Image Packs, and royalties for sales on Adobe Stock (except for the 750 image subscription) should be paid at $0,99 or more – compared to the 1 credit sales at Fotolia which can pay as low as $0,20. We will have to wait for some time to see how the split between subscription sales and the monthly image packs will work to figure out how the average royalties will develop. Overall there seems to be indication that the average royalty per download (RPD) should be slightly higher for Adobe Stock sales than on the Fotolia platform for many contributors.

What is the Outlook for the Future of Adobe Stock vs. Fotolia's?

The integration of Adobe Stock directly into the design products will make creation of design and purchasing of media a very easy process for the buyers. We predict that Adobe has a good chance to convince existing buyers into offering an additional service with this platform.

On the other hand, Fotolia has made several tries to gain market share in the important US market, apparently not very successful in the past. With Adobe in the back, we expected this to change since we learned about the acquisition. Whereas especially in central Europe – and as a standalone platform outside of the Adobe world – Fotolia has a significant stand. For these reasons we do not believe that Fotolia will be fully integrated into Adobe Stock in the short or mid term either.

It will be integrated more tightly over the coming years, though: On the buyer side, Adobe Stock does not offer video yet nor Extended Licenses (yet). Those will certainly follow at some point but for the time being, buyers will continue to be send towards the Fotolia site for these offers.

PSD, Lightroom Templates, After Effects Templates for Sale soon?

On the contributor side, Adobe is likely to also extend the Fotolia market platform towards other media. There already is a market for so many products like presets for Adobe Lightroom, actions for Photoshop, templates for After Effects. All those sales are happening outside of the traditional “stock image” market so far. We are curious to see if (or more likely: when) all these products based on the Adobe technologies will also become part of the same market place. A good start could be to include a link “Export to Fotolia for sale” within the Lightroom software very soon.

Finally a positive Outlook for Stock Photographers

All of this seems to be a very positive outlook to the Adobe Stock and Fotolia market places for the future. The acquisition and integration offers a lot of potential. With that being said it isn't quite as certain that contributors will profit from more sales. In the end, many of those media buyers who will go for the new Adobe Stock offer, are likely already customers of other stock media platforms like Shutterstock or iStock. A large amount of the sales that Adobe Stock will generate could only replace sales through other platforms in the end. Then again, the success of Apple with its AppStore shows that sometimes the software platform is only a first step and that a company can make good business by integrating open market places tightly into their offer.

The future may not look bright but it has certainly become a bit more interesting to find out with yesterday's news.

UPDATE 17.06.2015 03:10: Fixed the wrong commission explanation.